Real estate agents and buyers are often faced with the dilemma of trying to calculate the maximum purchase price a buyer can afford to pay based upon certain buyer criteria.

- The buyers desired cash down payment

- The buyers desired monthly mortgage payment

- The buyers anticipated mortgage rate and terms

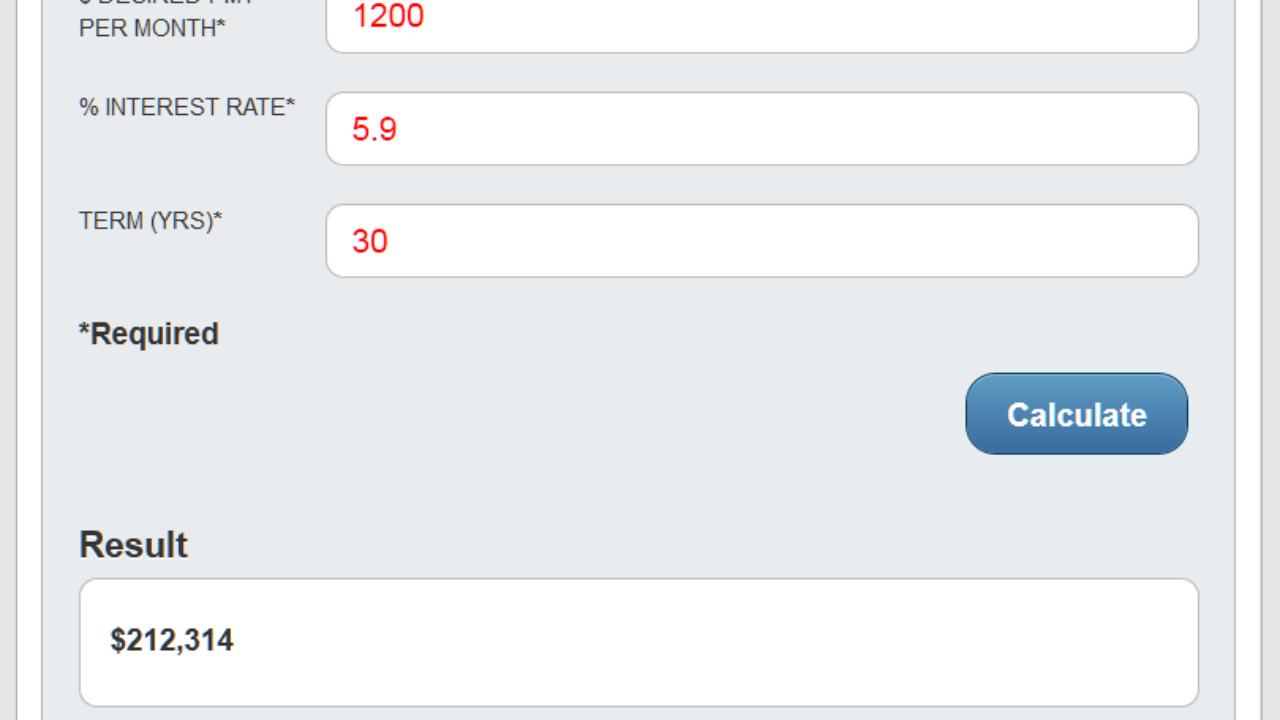

For example, let’s say that the buyer has $10,000 cash to put down, can afford to pay $1,200 per month, and would reasonably expect a bank to quote a fully amortized thirty-year loan at 5.9% interest rate.

The solution is fairly straightforward: cash down + loan amount = the maximum purchase price.

Okay, but the challenge is being able to calculate the correct loan amount at an interest rate of 5.9% that will fully amortize at $1,200 per month (principal and interest) for 30 years.

To make it easy for you, we have included a Maximum Price calculator in our Pro RE Calculator program. You just enter four lines of data to get the result. (Note illustration below).

So You Know

The buyer’s maximum purchase price is just one of over sixty online real estate calculators available in Pro RE Calculator. See them all at real estate calculators